Ford Scales Back Electric Vehicle Strategy, Faces $19.5 Billion Impact

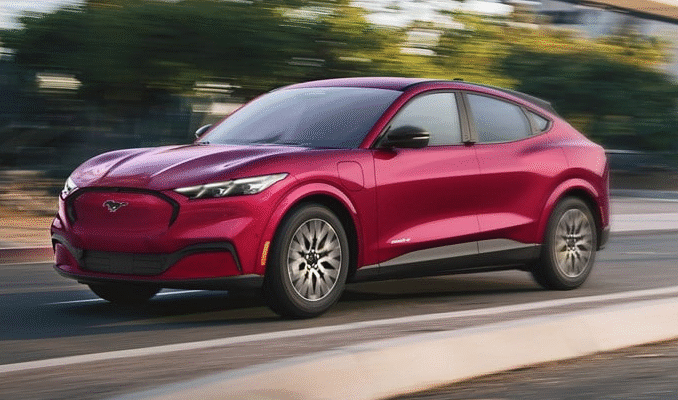

Ford has announced a major shift in its electric vehicle (EV) strategy, moving away from plans to produce large electric models due to weak consumer demand and changes in US regulations.

The American carmaker said it will now focus more on profitable hybrid vehicles, traditional petrol-powered models, and smaller, lower-cost electric cars. As a result of this strategic change, Ford expects a financial impact of about $19.5 billion (£14.6 billion).

In a statement, Ford said the business case for large electric vehicles has weakened because of slower-than-expected EV adoption, rising production costs, and regulatory rollbacks introduced under US President Donald Trump’s administration.

Ford Chief Executive Jim Farley described the move as a customer-driven decision aimed at strengthening the company’s long-term profitability.

“The operating environment has changed,” Farley said, adding that Ford will redirect investment toward trucks, vans, hybrid models, and its energy storage business.

As part of the new plan, Ford confirmed it will not launch a fully electric version of its popular F-150 pickup truck. Instead, the F-150 Lightning will be redesigned as a hybrid vehicle using a petrol-powered generator. The company also announced the cancellation of a planned electric van, choosing instead to continue producing petrol and hybrid versions.

Ford’s announcement follows a similar move by General Motors, which revealed last year that it would scale back its EV targets and absorb a $1.6 billion hit due to slowing demand.

Electric vehicle adoption in the United States has lagged behind markets such as China, the UK, and Europe. Industry experts say reduced government incentives and policy support have played a key role.

Earlier incentives that reduced EV prices by up to $7,500 have now ended, and recent changes to fuel economy rules have further slowed momentum in the sector.

While some industry leaders welcomed the regulatory changes as being more aligned with consumer demand, environmental groups criticised the move, warning it could slow progress on emissions reduction.

Meanwhile, Europe is also reconsidering its long-term EV policies, with the European Union expected to soften plans to phase out combustion engine vehicles by 2035 amid pressure from major car manufacturers.